Introduction: The Current Landscape of British SMEs

The United Kingdom’s small and medium-sized enterprises (SMEs) are the backbone of the nation’s economy, representing over 99% of all businesses and employing more than 16 million people. In recent years, however, the landscape for British SMEs has become increasingly complex. Rising cost pressures—from energy to raw materials—are squeezing already tight margins, while access to skilled labour remains a persistent challenge across key sectors such as manufacturing, retail, and professional services. Compounding these issues is the growing expectation from customers and stakeholders for greater efficiency, transparency, and adaptability in business operations. For many SME leaders, these hurdles are not just operational headaches; they directly impact profitability, cash flow management, and long-term viability. Navigating this evolving environment demands not only resilience but also innovation—particularly in how businesses deploy technology to streamline processes and optimise resources. As we look towards sustainable scale for British SMEs, understanding this context is essential before exploring how artificial intelligence (AI) and automation can provide tangible solutions.

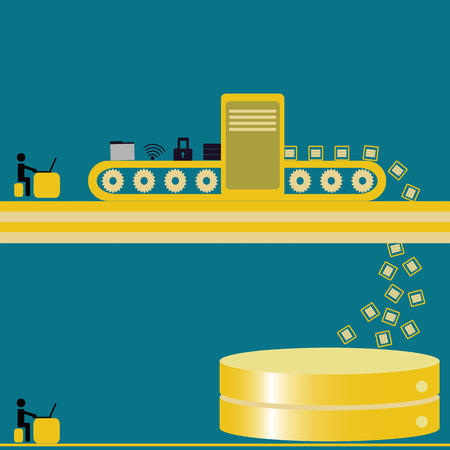

2. AI and Automation: From Buzzwords to Business Enablers

Artificial Intelligence (AI) and automation have evolved far beyond industry jargon, emerging as practical solutions that empower British SMEs to thrive in a competitive landscape. By integrating these technologies, local businesses can drive efficiency, reduce manual errors, and unlock sustainable growth. But how are these tools being applied on the ground? Let’s explore some real-world examples from across UK industries.

Practical Tools Tailored for British SMEs

Many technology providers now offer AI-driven platforms specifically designed for the unique needs of small and medium-sized enterprises. Key applications include automated bookkeeping, smart inventory management, predictive analytics for sales, and personalised customer communications. The table below highlights practical tools used by UK businesses:

| Tool | Industry Application | Key Benefit | UK Example |

|---|---|---|---|

| Xero + Hubdoc | Accounting & Bookkeeping | Automated invoice processing and reconciliation | Cotswold-based consultancy streamlining monthly accounts |

| Katanamrp | Manufacturing & Inventory | Real-time stock tracking using AI forecasts | Bristol craft brewery reducing overstocking costs |

| Sage Intacct | Financial Management | AI-driven cash flow insights and scenario planning | London creative agency managing project budgets smarter |

| Chatbots (e.g., ManyChat) | Customer Service & Sales | 24/7 customer engagement with automated responses | Manchester e-commerce shop boosting online conversions |

| PandaDoc + Zapier Integration | Document Automation & Workflow | E-signature and contract automation linking multiple apps | Birmingham legal firm accelerating client onboarding |

The Local Impact: Real-World Success Stories

Consider a Yorkshire-based food producer who adopted an AI-powered demand forecasting tool. By analysing historical sales data alongside market trends, they cut waste by 18% while ensuring shelves were always stocked during peak demand periods. Similarly, a Midlands logistics company implemented robotic process automation (RPA) to handle repetitive scheduling tasks—freeing up their team to focus on building strategic partnerships.

The Path Forward: Making AI Accessible for Every SME

The most successful British SMEs approach AI not as a replacement for human expertise but as a force multiplier. With cloud-based subscriptions and modular integrations now widely available, even microbusinesses can start small—automating single processes before scaling up across departments. Ultimately, it’s this incremental approach that allows businesses to manage cash flow prudently while steadily reaping the benefits of digital transformation.

3. Financial Prudence: Maximising Cash Flow with Technology

For British SMEs navigating uncertain economic waters, financial prudence is not just a virtue—it’s a necessity. The adoption of AI-powered systems offers a decisive advantage in streamlining core financial processes such as invoicing, credit control, and cash management. By integrating automation into these areas, businesses can optimise their working capital cycles and significantly reduce the risk of bad debt, directly supporting sustainable growth.

Automated Invoicing: Faster Payments, Fewer Errors

Traditional manual invoicing is time-consuming and error-prone, often leading to payment delays and disputes. AI-driven platforms can generate and dispatch accurate invoices instantly upon service delivery or product shipment. With smart reminders and automatic reconciliation, late payments become the exception rather than the norm—boosting liquidity and freeing up staff for value-added tasks.

AI in Credit Control: Intelligent Risk Management

Effective credit control is vital for British SMEs operating on tight margins. AI algorithms can analyse customer payment histories, sector data, and macroeconomic indicators to assess creditworthiness in real-time. This enables more informed decisions about extending credit terms or requiring upfront payments. Automated alerts highlight potential slow-payers early, allowing proactive engagement and negotiation before cash flow problems escalate.

Optimised Cash Management: Data-Driven Decision Making

With access to live financial data, AI-powered dashboards provide business owners with a clear view of incoming and outgoing cash flows. Predictive analytics help forecast future requirements based on seasonality, market trends, and customer behaviour. This empowers SMEs to make strategic decisions about investment, inventory, and staffing—ensuring they have enough liquidity to seize opportunities while cushioning against unforeseen shocks.

The cumulative impact of these technologies means that British SMEs are better equipped to manage their finances with precision and agility. By harnessing AI for cash flow optimisation, they can safeguard profitability, maintain healthy working capital ratios, and build resilience for sustainable scale in a competitive marketplace.

4. Building a Resilient Workforce Through Upskilling

For British SMEs aiming to scale sustainably, integrating automation is only half the equation—upskilling the workforce is equally critical. The rapid evolution of AI and automation presents both challenges and opportunities for UK businesses, particularly when it comes to employee adaptability. To ensure resilience, SMEs must invest in UK-specific skill development strategies that empower their teams to thrive alongside transformative technology.

Why Upskilling Matters in the Age of Automation

The introduction of automation can trigger concerns about job security. However, forward-thinking SMEs treat technology as a tool to augment human capability rather than replace it. By equipping employees with new digital skills, businesses not only future-proof their workforce but also unlock productivity gains and foster innovation—key drivers for sustainable growth.

Key Areas for UK-Focused Upskilling

| Skill Area | Description | UK-Specific Relevance |

|---|---|---|

| Digital Literacy | Proficiency in using digital tools and platforms essential for modern business operations. | Bridges the digital divide between regions, especially outside London and the South East. |

| Data Analysis | Ability to interpret and leverage data insights for decision-making. | Supports compliance with UK data regulations (GDPR) and enhances local market understanding. |

| Change Management | Skills in leading teams through technological transitions. | Facilitates smoother adoption of automation across diverse UK business cultures. |

| AI Collaboration | Working effectively alongside AI-driven systems and processes. | Ensures ethical use of AI in line with emerging UK legislation and standards. |

| Sustainability Practices | Knowledge of environmentally responsible operations supported by tech. | Aligns with the UKs Net Zero goals and customer expectations for green business. |

Tangible Strategies for British SMEs

SMEs should prioritise regular training programmes, partnerships with local educational institutions, and access to government upskilling initiatives like the UK Skills Toolkit or Apprenticeship Levy funding. This not only sharpens employee competencies but also strengthens loyalty by demonstrating a commitment to long-term career growth. Emphasising lifelong learning ensures that staff remain agile as technology—and customer expectations—continue to shift.

5. Sustainability and Compliance in a Digital Age

For British SMEs, the transition into a digital-first economy is no longer a future ambition but an operational necessity—especially when it comes to sustainability and regulatory compliance. Leveraging advanced digital solutions empowers SMEs not only to meet the growing demands of environmental, social, and governance (ESG) reporting but also to stay aligned with evolving UK regulations.

Leveraging Digital Tools for ESG Reporting

With heightened investor and consumer focus on ESG credentials, SMEs must provide transparent, data-driven insights into their sustainability performance. Cloud-based platforms and AI-driven analytics streamline the collection, analysis, and presentation of ESG metrics, allowing SMEs to generate real-time dashboards and automated reports. This reduces manual errors and resource drain while enhancing credibility with stakeholders.

Navigating UK Regulatory Requirements

The UK government has steadily tightened its regulatory framework around sustainability disclosures, carbon reporting, and corporate governance. Digital compliance tools help SMEs track legislative changes, automate compliance checks, and maintain accurate records for audits. By integrating automation into compliance workflows, businesses can reduce risk exposure and administrative costs—freeing up cash flow for strategic investments.

Minimising Carbon Footprint for Sustainable Scale

AI-powered energy management systems and supply chain optimisation tools enable SMEs to monitor and minimise their carbon footprint across operations. From smart metering in office spaces to predictive logistics that cut unnecessary transport emissions, these technologies deliver quantifiable reductions in environmental impact. Importantly, they position SMEs as responsible partners within their supply chains—an essential factor in winning contracts with larger corporates committed to Net Zero goals.

In summary, embracing digital solutions for ESG reporting and compliance is not just about ticking boxes; it is about building a resilient business model that supports sustainable growth. For British SMEs aiming for long-term scale, digital sustainability is fast becoming a non-negotiable pillar of competitive advantage.

6. Roadmap to Scalable Success

Step 1: Assess Readiness and Identify Priorities

British SMEs must begin their AI and automation journey with a clear assessment of current digital maturity. Evaluate existing processes, highlight inefficiencies, and identify areas where automation or AI could deliver measurable impact. This foundational audit ensures resources are focused on high-value opportunities while aligning with both growth ambitions and sustainability goals.

Step 2: Pilot with Purpose

Start small by selecting a specific process or department for an initial pilot. For example, automate invoice processing, customer service enquiries, or inventory management—tasks where automation shows rapid ROI. Leverage local government innovation vouchers, such as those from Innovate UK or regional Growth Hubs, to offset upfront technology costs and access expert guidance.

Step 3: Upskill Your Workforce

Successful adoption relies on a workforce ready to embrace change. Invest in digital skills training via local colleges, government-funded schemes like the Skills Bootcamps, or online platforms supported by the Department for Education. This helps your team transition smoothly and maximises the value derived from new technologies.

Step 4: Secure Funding & Partnerships

Explore government grants and private sector partnerships that support digital transformation. The British Business Bank’s Start Up Loans, Digital Growth Grants, and local LEP funding initiatives can provide essential capital. Engage with tech accelerators or university innovation centres to tap into R&D expertise tailored for SMEs.

Step 5: Scale Responsibly and Sustainably

Once pilots demonstrate success, roll out proven AI and automation solutions across more business units—always measuring impact against KPIs like cost savings, productivity gains, and reduced environmental footprint. Prioritise platforms that integrate well with existing systems and comply with UK data privacy standards. Regularly review processes to ensure continuous improvement and sustainable scaling.

Looking Ahead

The future for British SMEs lies in calculated investment and strategic adoption of AI-driven solutions. By leveraging available government support, prioritising employee readiness, and focusing on scalable pilots, SMEs can chart a course towards sustainable growth—cementing their role as resilient drivers of the UK’s digital economy.